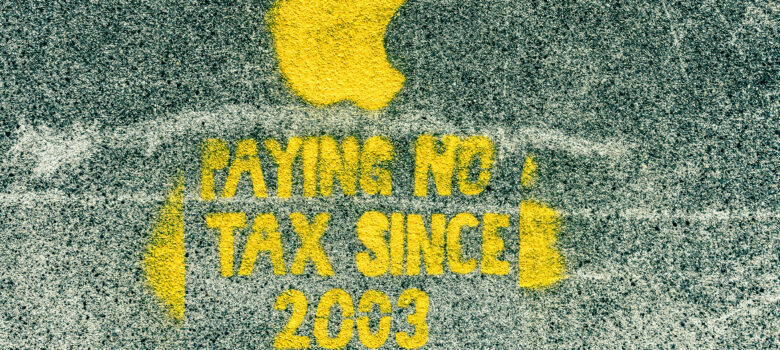

The Canadian government released a detailed document last week outlining the specifics behind its draft Digital Services Tax Act. No actual legislation has yet been passed, but the government is providing guidance on how the potential law would be interpreted assuming it takes effect next year. The document has sparked criticism from business groups and the U.S. government given that it envisions a retroactive three percent tax that will hit a wide range of businesses. Further, the Canadian plan is facing significant opposition from many OECD countries since it may jeopardize a global agreement that is designed to address the digital services tax issue. While the digital services tax (DST) is typically framed as a tax on big tech, the reality is that the Canadian version extends far beyond just companies such as Google and Facebook, potentially including major Canadian retailers such as Canadian Tire, Loblaws, and others.

My view is that unlike Bills C-11 and C-18, which create cross-industry subsidy models funded by tech companies to support government policy, appropriate taxation models is the far better approach to ensure that companies “pay their fair share”. While a DST may be a good approach (particularly if part of a global system), the Canadian plan to implement the tax retroactively next year creates some significant risks. In fact, our current approach raises the prospect of U.S. tariff retaliation, opposition from many allies at the OECD, and expanded news link blocking in response to Bill C-18.

First, the Canadian DST is exceptionally complex, covering a wide range of digital revenues that occur in Canada. The baseline applicability is for companies that generate 750 million euros (about C$1.1 billion) in global revenue of which at least $20 million is digital services revenue in Canada. Digital services revenue can arise from (1) online marketplace services revenue (which would cover an Ebay, Airbnb or Uber), (2) online advertising services revenue (Google or Microsoft), (3) social media services revenue (Facebook or TikTok), and (4) user data revenue (any company that collects and sells user data). Because the threshold involves general global revenues and Canadian digital service revenues, the companies likely to be caught by the DST involve far more than just U.S. Internet companies.

The rules for each of the digital service revenue categories gets very complicated very quickly. For example, consider the guidance related to the need for the digital services revenues to occur in Canada. The law requires that the user be located in Canada, which the government says will be based on a reasonableness test. Take targeted advertising revenues, which would require that the user be physically located in Canada at the time. But what if the user uses a privacy tool to limit the tracking? Those ads are excluded:

A social media platform has a user who uses a privacy filter that prevents any personal information from being collected by the interface. Additionally, the content posted by the user on the social media platform does not indicate the user’s location. As the social media platform has no data by which to determine location, this user is not considered located in Canada or outside of Canada. As such, the user is not a user of determinable location.

What if the user ships goods from an online marketplace to Canada but the billing address in the U.S.? The government says that revenue is treated as Canadian:

An online marketplace has a user that participated in multiple transactions on the marketplace. Their shipping address is in Canada and their billing address is outside Canada. In such a case, it may be reasonable to conclude that the user is in Canada and outside Canada. Because of the default rule, such a user would be considered a user located in Canada (and a user of determinable location).

These are just two examples. Since the law applies retroactively to all transactions since the start of 2022, it involves reviewing literally billions of transactions and advertisements to determine location, revenues, and more. This is certainly isn’t disqualifying, but it’s complicated.

Second, the political situation associated with the Canadian DST creates some very significant and potentially costly risks. At the bi-lateral level, the U.S. has stated unequivocally that it will retaliate against a Canadian DST, raising the spectre of billions in retaliatory tariffs. The U.S. tariffs would not necessarily target Canadian tech companies, but could be used to target anything such as steel, dairy, or lumber. In other words, it can target the most sensitive areas for maximum impact. If the U.S. does indeed impose retaliatory tariffs, the net gain from the DST could be largely wiped out. The Canadian gamble appears to be a replay of Bill C-18, where it bet that companies such as Meta would not go ahead with news blocking. In this instance, the bet is that the U.S. will not retaliate. Yet with the Canadian DST undermining President Joe Biden’s plan for a global tax deal and the DST to take effect during a U.S. presidential election year in which domestic policy is likely to play a major role, that appears to be a risky bet.

Third, the Canadian approach also creates global risks with leading allies since it may undo an agreement at the OECD to address the proliferations of DSTs. Canada has said it would only impose its DST if the OECD model does not take effect. While the original start date of the end of 2023 no longer seems realistic, virtually all other countries agreed to extend the deadline by a year. Canada stands virtually alone in opposing the extension, which has raised tensions with other countries.

Fourth, the Canadian DST approach may also have implications for Bills C-11 and C-18. While those laws stand apart from the DST, the bottom line is that hundreds of millions in DST tax liability combined with mandated payments of hundreds of millions for Cancon or news links from the same pot of money is going to have an impact. The retroactive application of a DST seems likely to increase consumer costs in Canada as the tax liability is passed along to Canadian consumers, lead to a challenge of Bill C-11 costs, and make a deal with Google on mandated payments for links far less likely. If that is the case, the DST would increase the chance the company complies with Bill C-18 by following the Meta model of removing links to Canadian news and canceling existing news deals. In other words, it will be Canadian news outlets and the Canadian public that bear the brunt of those costs. The government may still insist that it does not want to wait any further on the DST, but Canadians should at least recognize the costs and risks associated with the decision.

“Since this is an era when many people are concerned about ‘fairness’ and ‘social justice,’ what is your ‘fair share’ of what someone else has worked for?”

― Thomas Sowell

My initial check is for $27,000. This is the first time I’ve actually earned something, and I’m very happy about it. I’m going to work even harder from now on and I can’t wait for my paycheck sb09 the following week. For further information, click the home tab.

.

.

Utilizing Here———————————————————>>> WORK AT HOME

specificsalaery.blogspot.com/

Monetary emergencies is a major danger of the century which influences truly, intellectually and monetarily/To conquer these troubles and take full advantage of this prisoner period and make internet procuring. For more details

.

.

visit this article _______specificsalaery.blogspot.com/

> My view is that unlike Bills C-11 and C-18, which create cross-industry subsidy models funded by tech companies to support government policy, appropriate taxation models is the far better approach

But when the U.S. retaliates with tariffs on other sectors, this DST (a taxation model) devolves (almost) into a “cross-industry subsidy model”. The only difference is that it’s the Canadian government getting the money from an unrelated industry in Canada.

If Canada charges $100 in DST to (say) Google, and the U.S., in retaliation charges a (like-for-like) $100 tariff on Canadian steel, Canada might as well just eliminate the middle-men (Google and the USTR) and take the $100 directly from Canadian steel companies. That’s the end result after-all.

I’d love to see how Canadian steel companies react when they have a DST applied to them.

Yes, not a case of if, but when, the US retaliates. I can think of a number of items that Congress has passed retaliatory tariffs on, even, in some cases, situations where Canada was within its treaty rights. For instance, softwood lumber, steel, aluminum, etc.

I’ve got my first check total of thirteen thousand US dollars. I am so excited, this is the first time i Actually earned something. I am going to work even harder now and I can’t wait for next week’s payment. Go to the home tab for more detail.

I highly recommend everyone to apply…

A DST is essentially a sales tax. The companies that have to pay it will simply add a DST fee onto what they charge customers in order to end up with the same net revenue. Rather than going down this route it would be simpler to increase the HST rate on digital services.

It looks like Bell, Rogers and the CBC will have to pay this tax, so expect them to lobby Ottawa for exemptions.

If this tax is implemented expect it to expand to other digital services, like Netflix subscription fees, in the near future.

I would expect they will list the DST initially as a separate line item in the bill sent to their customers. In any case, expect that HST will also be paid on the DST that is passed on, meaning that the impact to the customer is even worse. In the same way that PST was charged on the pre-GST Manufacturer’s Sales Tax (back in the late ’80s).

Pingback: Leftover Links 10/08/2023: CNET is Burning Past Journalism | Techrights

If you have Buffalo Air & Electrical install a split system air conditioning system, you will not only be comfortable, but you will also be certain that the air con installation technique will be of the highest professional standard. You can click to know more. Every installation comes with its own workmanship warranty, which means that if something goes wrong with a system done by Buffalo Air & Electrical, they will come out and fix it without question.

The only difference is that it’s the Canadian government getting the money from an unrelated industry in Canada.

amid the excitement of technological progress, there’s something enchanting about the traditional cinema experience.

Amazon is big in advertisement, Apple is playing catch up. So that category is not just Google and Microsoft.

I learned something new today, thanks to your blog