“Appeals have been declining in popularity over the last decade, with no apparent explanation. No other trends at the USPTO appear to explain the reduced number of ex parte appeal filings.”

Once a rejection by the U.S. Patent and Trademark Office (USPTO) is designated as at least one “final” office action (which typically occurs when the office action is at least a second office action issued after filing), the applicant has the opportunity to engage with a different decision-maker. That is, the applicant can appeal a pending rejection to the Patent Trial and Appeal Board (PTAB), and at least three PTAB judges will then evaluate the rationale provided by the examiner and applicant (referred to as an “appellant” when the PTAB is handling a matter). Alternatively, the applicant can continue to engage with the examiner (which may require filing a Request for Continued Examination and paying the associated fee) or can let the application go abandoned.

Once a rejection by the U.S. Patent and Trademark Office (USPTO) is designated as at least one “final” office action (which typically occurs when the office action is at least a second office action issued after filing), the applicant has the opportunity to engage with a different decision-maker. That is, the applicant can appeal a pending rejection to the Patent Trial and Appeal Board (PTAB), and at least three PTAB judges will then evaluate the rationale provided by the examiner and applicant (referred to as an “appellant” when the PTAB is handling a matter). Alternatively, the applicant can continue to engage with the examiner (which may require filing a Request for Continued Examination and paying the associated fee) or can let the application go abandoned.

Ex Parte Appeals are in Freefall

To evaluate the extent to which applicants choose to appeal rejections to the PTAB, we analyzed PTAB statistics from the USTPO. Specifically, we tracked (for each fiscal year between 2001-2021): the number of appeals received by the PTAB for each year, decision breakdowns for each year, and appeal pendency.

FIG. 1 shows the number of appeals received by the PTAB across years. The highest number of ex parte appeals received in a year was in 2009, with 15,483 ex parte appeals received at the PTAB. Thereafter, the number of appeals filed has generally been in steep decline. From 2013 to 2016, the number of appeals fell from 11,090 to 8,688. After a jump to 11,776 appeals in 2017, the number of appeals filed has been dropping sharply, to 9,284 in 2018; 7,025 in 2019; 6,836 in 2020; and 4,280 for 2021 to date. That is, the number of appeals received by the PTAB in 2021 was a mere 28% of the number of appeals received in 2009.

FIG. 1 – Ex Parte Appeals Received at PTAB per Year

The reason for the decrease in ex parte appeals is not clear. The reversal rate at the PTAB has been relatively steady since 2009, as shown in FIG. 2. Thus, there is no apparent change in PTAB reversal rates over the last 10 years that would dissuade applicants from appealing. In fact, the percentage of reversals rose from 2009 to 2011 (42.9% to 49%), while the number of appeal filings dropped (from 15,483 to 13,740). More recently, the reversal percentage has been steadily around 40% (42.6% in 2017; 39.2% in 2018; 40.6% in 2019; 39.6% in 2020; and 43% in 2021 to-date), while the number of appeals filed dropped significantly.

FIG 2. – Percent of Ex Parte Appeals Reversed or Reversed in Part per Year

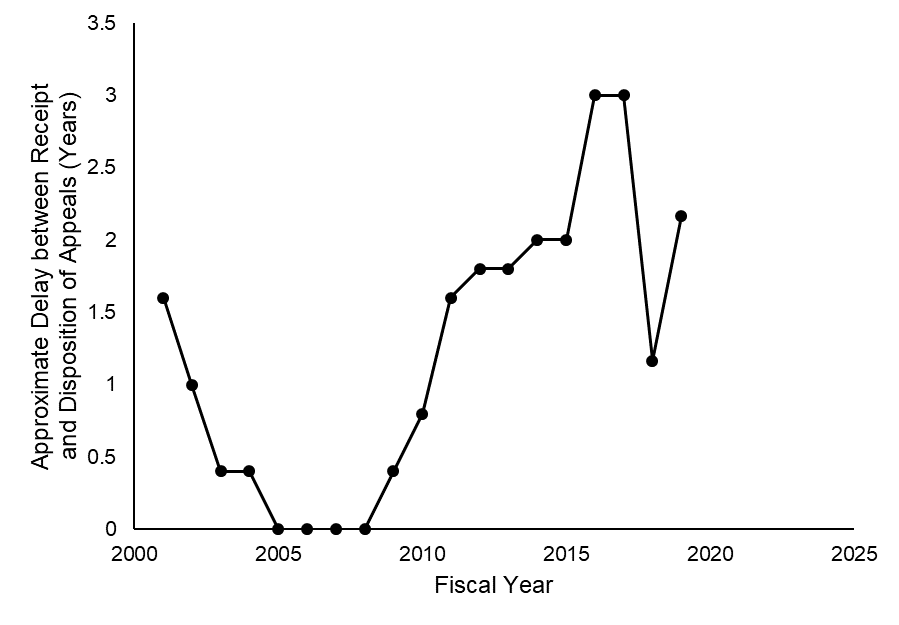

To investigate whether delays in appeal processing were anti-correlated with appeal counts, we calculated an approximate delay metric. The USPTO annual reports on Appeals Receipts and Dispositions identified in which fiscal years the vast majority of appeals were received that were being decided by the PTAB (at the end of the reported fiscal year). These years were separated by technology area (e.g., biotechnology, chemistry, etc.). As a very crude metric for delay, for each of the technology areas, the authors subtracted the received-by year from the year of the report. These differences were then averaged across technology areas.

FIG. 3 shows the approximate delay between the receipt and decision years. For example, in 2019, the PTAB was processing appeals received in 2017, and there was a delay of approximately two years. Meanwhile, in 2015, the PTAB was processing appeals received in 2013 and there was a delay of approximately two years. From 2005-2009, there was little delay between year of receipt and the decision. During that point, the number of appeals filed was rising. Potentially the reduced delays encouraged applicants to appeal during this period. However, from 2009 onwards, there is no apparent correlation between delays and ex parte appeal filings. In particular, while the delay decreased significantly between 2018 and 2019, the number of appeals filed also decreased significantly between 2018 and 2019, as well as between 2019 and 2020.

FIG. 3 – Approximate Appeal Time per Year

It is possible that changing USPTO guidance and case law dissuaded applicants from appealing in certain art units across the last decade. However, there does not appear to be a correlation between the number of appeals filed and the major changes in USPTO guidance and case law.

For example, in 2014, the USPTO issued new instructions based on Alice Corp v. CLS Bank Int’l, and made the standard for Section 101 much more difficult for applicants, particularly for business methods and certain biological inventions. Further, in 2019, the USPTO issued a revised subject matter eligibility guidance, which made the 101 analysis a bit more applicant-friendly.

However, as shown in FIG. 1, the downward trend in appeals began before the Alice decision. In 2019, the revised guidance (which supported various types of eligibility arguments) was instituted. Nonetheless, the downward trend in appeal filings continued. Thus, the changes in USPTO guidance did not appear to explain the downward trend either.

Given that the number of applications filed each year has steadily increased, the drop in appeals is not explained by any decreases in patent filings. The percentage of pending cases on appeal exhibits a similar pattern of increase and decrease as the total number of cases on appeal.

It’s a Mystery

Thus, appeals have been declining in popularity over the last decade, with no apparent explanation. No other trends at the USPTO appear to explain the reduced number of ex parte appeal filings. There is no clear correlation between the drop in appeals and affirmation rates or delays at the PTAB. Nor do changes in USPTO guidance seem to explain the decrease in appeal filings. Assessing appeal and examination statistics for specific technology sectors may provide a potential explanation for the dramatic plunge in appeal filings.

Image Source: Deposit Photos

Author: bloomua

Image ID: 20566277

![[IPWatchdog Logo]](https://ipwatchdog.com/wp-content/themes/IPWatchdog%20-%202023/assets/images/temp/logo-small@2x.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/05/Quartz-IP-May-9-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2024/04/Patent-Litigation-Masters-2024-sidebar-700x500-1.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/WEBINAR-336-x-280-px.png)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/2021-Patent-Practice-on-Demand-recorded-Feb-2021-336-x-280.jpg)

![[Advertisement]](https://ipwatchdog.com/wp-content/uploads/2021/12/Ad-4-The-Invent-Patent-System™.png)

Join the Discussion

20 comments so far.

Night Writer

September 29, 2021 06:04 am@18 David Lewis

I think that is a fair point. I see that a lot where large clients just abandon applications all the time. It is would be interested to see the abandonment rate compared with the appeal.

If the patent is now worth $150K rather than $1 million dollars than it is hardly worth spending $15K to roll the dice on an appeal.

Patents have become like junk bonds.

ipguy

September 28, 2021 05:00 pm@14

Mr. Kwok has hit the nail on the head. The numbers merely reflect changes in administrations.

“The highest number of ex parte appeals received in a year was in 2009”

Basically, the aftereffects culminating from the lingering anti-allowance attitude of the USPTO during the Bush Administration.

“From 2013 to 2016, the number of appeals fell from 11,090 to 8,688.”

The Obama Administration and Director Kappos.

“After a jump to 11,776 appeals in 2017”

The start of the Trump Administration and a seeming return to an anti-allowance attitude on the examiner level.

“the number of appeals filed has been dropping sharply, to 9,284 in 2018”

Director Iancu was nominated in November 2017 and a more pro-allowance attitude from upper management.

David Lewis

September 26, 2021 03:27 am2010 is when Bilsky was decided, which placed some uncertainty about the enforce-ability of software related patents, and therefore decreased their value. The AIA invent act was passed in 2011 and came into force in 2016, which introduced IPRs, which further devalued patents. I think that the decrease in appeals may reflect the decrease in value of patents. If patents are worth less, the added expense of an appeal makes less sense. That may be speculation and may not explain the entire trend curve, but seems like a reasonable theory.

Texas Patent Lawyer

September 21, 2021 04:17 pmI think the wrong question is being asked. The right question is why was there a spike. If you recall, the patent office solution to “low quality” patents was to implement a reject first, study the claims later policy. The number of improper rejections went way up causing the appeals to go up. When Dir. Kappos took over and refocused the Office strategy the bad rejections went down. What we see now is a return to the levels prior to the spike

Night Writer

September 21, 2021 03:15 pm@5 Ron provides a lot of good reasons for the fewer appeals.

Some of the trends I’ve noticed.

*) Clients less willing to appeal 101 cases rather than abandon them.

*) Clients preferring to file an RCE with amended or new claims.

*) Examiners being more compliant to good arguments. Usually you get an appeal when the examiners are being transient for something that is pretty obviously wrong. I’ve noticed that examiners tend to do this less and from what I’ve heard from the examiners this is because examiners get reviewed more often for finals and appeals.

Anyway, also, of course, the big one is that everyone appealed 101’s to put the application in a holding pattern hoping that sanity would be returned to the patent system. Now big corporations are doing everything possible to avoid 36xx AUs.

Jonathan Stroud

September 21, 2021 02:18 pmEcho the points related to after final interviews and KSR. Doesn’t seem all that mysterious to me. Appeals are costly and time-consuming and probably result in the same outcome as reopening prosecution, which I saw a fair bit of when I was there.

Edward Kwok

September 21, 2021 01:15 pmNo mystery at all. The one word answer is “Kappos,”

Speaking from personal experience, the Bush administration, apparently because of anti-troll lobbying, demanded “high-quality examination.” That was taken at the USPTO to mean that the Examiner’s job is not to issue allowance. Consequently, even though the number of original applications (not continuation or continuation in parts) fell drastically after the dotcom bust, pending applications rose. Appeals also rose, pretty much exponentially towards the end of the Bush administration.

Kappos became commissioner in August, 2009. The Kappos/Obama administration decided to return to being friendly to applicants. Cases were being allowed. The procedure of pre-appeal brief conference was instituted (thus, delay pretty much went to zero, as persistent, ridiculous rejections were summarily reversed).

As the huge backlog of pending cases worked through the system. I think we are now back to relatively high-quality examination and at a reasonable balance,

Michael J Stimson

September 21, 2021 11:41 amThe after final “pilot” program has been active since about the same time appeals took a dive. The appeals became ACFPs, which have been pretty darn successful in my experience.

Clint Mehall

September 21, 2021 10:48 amIn addition to the factors noted by prior commentators (case law – KSR and Alice and fee increases), I would be curious to know the influence of the Pre-Appeal Brief Request for Review. I assume the total numbers were based on appeals actually forwarded to the PTAB for a decision, and not Notice of Appeals or Appeal Briefs filed. According to metrics I am looking at, for application disposed over the past 5 years, 22.7% of appeals filed are resolved at the stage of the filing of a Pre-Appeal Brief Request for Review, while another 22.7% of appeals filed are resolved at the stage of the filing of an Appeal Brief, while only 46.6% are resolved via a Board Decision (my personal numbers are even lower = 36.6%). I would be curious to see the trend regarding the number of Notice of Appeals filed. From my experience, examiners are more actively trying to resolve appealed cases to avoid a Board Decision than they did 10 years ago.

J. Doerre

September 21, 2021 10:22 amI am assuming that “the number of appeals received by the PTAB” does not include cases where the examiner reopened without filing an examiner’s answer. I would be curious to see if the number of cases where this occurs has increased.

Paul F Morgan

September 21, 2021 09:51 amAn additional factor in reduced ex parte appeals in more recent years is the increasing corporate control and scrutiny of O.C. costs. For example, ex parte appeals now requiring approval of in-house patent attorneys and having fixed fee limits in some large companies. The more rapid technical obsolescence of modern technologies might also be a factor?

Here to correct misinformation

September 21, 2021 08:27 amThe statutory requirement for appeal is that the claims be twice rejected. There is no requirement that the OA be designated “final” in order to appeal.

Anon

September 21, 2021 08:05 amSpike in appeals was due to low allowance rate 2006-2010… when Kappos took over appeals started to return to normal. Alice was 2014. 2006-2010 reduction in allowances had nothing to do with the law…. That was just PTO policy. The 2016 spike could be interpreted as correlating with major changes in subject matter eligibility.

MaxDrei

September 21, 2021 04:40 amOr, to put it another way (so as to explain why the reversal rate is still above 40%) perhaps in the past one always appealed because there was always good prospects of reversal, these days one only appeals those far less common decisions that are egregiously wrong.

MaxDrei

September 21, 2021 04:36 amI wonder whether the steady decline in the number of ex Parte appeals has something to do with a rise in the efforts a PTO makes to measure “quality”. I mean, one aspect of quality is getting it right first time. Therefore, every time an ex Parte appeal succeeds, that’s a negative data point for the “quality” of the PTO work product and nobody inside the USPTO wants to be responsible for generating a quality-negative data point.

Perhaps the world outside the USPTO has sensed that it is increasingly pointless to file an ex Parte appeal because the chances of its succeeding are, year on year, smaller?

Ron Katznelson

September 21, 2021 02:47 amThanks Kate and Vanessa. This is interesting data.

I take issue, however, with your conclusion that appeals have been declining “with no apparent explanation” and that “[n]o other trends at the USPTO appear to explain the reduced number of ex parte appeal filings.” Your analysis is incomplete, as it lacks basic controls and proper accounting for known explanatory correlates and confounding factors.

First, the trend you show for the absolute number of appeal filings per se is meaningless as a proxy for appeal propensities. Appeals arise only from final rejections — not from allowances. Thus, the relevant metric for appeal propensity is the number of appeal filings as a percentage of the number of applications that were finally rejected. Table 1 in the PTO Annual Report for FY2020 reveals a trend suggesting significant decline in the number of finally-rejected applications in the last five years. The number of disposals declined from 681,363 in FY16 to 657,948 in FY20 while the number of allowed applications increased from 363,022 in FY16 to 405,884 in FY20. The difference between disposals and allowances is a good estimate of final rejections and this means that the estimated final rejections declined from 318,341 in FY16 to only 252,064 in FY20 — about 21% reduction in only 5 years. This overall trend may be more pronounced in the time span of 2001-2021 that you cover. Naturally, given a fixed propensity to appeal, a decline in the number of finally-rejected applications would correspond to a decline in appeal filings. A detailed FOIA request that summarizes application-specific final rejection and appeal data by year would be more accurate in evaluating this trend.

Second, you ignored the known confounder of increases in appeal fees, which tend to independently suppress filings of appeals. Total appeal fees for large entity (Notice of Appeal + filing Appeal Brief) more than doubled from $1,240 as set by the AIA in 2011 to $3,400 today. The elasticity (of demand) for a given service is defined as the percentage change in the quantity of the service demanded by users divided by the percentage change in the fee for that service. The PTO estimated the average price elasticity for appeals to be –0.15 and –0.33 for large and small entities respectively. See Table 1 at http://www.uspto.gov/sites/default/files/documents/Elasticity_Appendix_July2019.docx. This means that, all else being equal, a doubling in real dollars of appeal fees (as occurred since 2011) is expected to cause a 15% and 33% decline in demand for appeals by large and small entities respectively.

Evidently, it is manifestly incorrect that “no other trends at the USPTO appear to explain the reduced number of ex parte appeal filings.” To the contrary: a proper analysis should be performed by entity size using time series for the underlying final rejections, the appeal fees, and should also factor-in the “appeal substitution” effects of RCEs by including RCE filings and RCE fees. A multiyear regression analysis should produce coefficients signifying the relative contribution of each of these variables to the decline in the number of appeals.

Capt. Obvious

September 20, 2021 11:11 pmIt’s not that hard to figure out.

The fees went way up, and people got tired of waiting for years.

Dozens

September 20, 2021 07:39 pmI do not pretend that what I am about to say explains all of the observed appeal-filing, but maybe I have a partial explanation.

It used to be that if I had a tough case and the business leads could not decide whether they wanted the claims to zig or to zag, we would file an appeal and that would put the case on ice for ~3 years while the business leads did some more market research and beta testing to decide where they want the project to go. Now, however, appeals are being decided in much less than 3 years. I have had cases in the last year where I received a PTAB decision within 6 months of paying the appeal forwarding fee.

In other words, appeal is no longer a good way to buy time for the business leads to come to a decision. Maybe some of the decline in appeals reflects the fact that appeals are no longer useful for one of the purposes for which people used to file them.

Anon

September 20, 2021 05:51 pmMy first impression was exactly what Mr. Doerre indicates.

J. Doerre

September 20, 2021 04:46 pmThere is a narrative where the real anomaly was the giant spike post-KSR and everything since then is just a gradual return to the prior level with some noise, some perturbations based on Alice, and some growth due to the greater number of patent application filings.