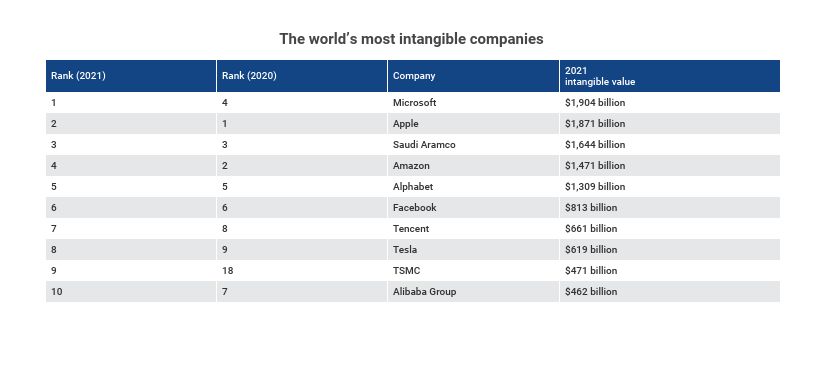

It’s no surprise that the world’s most ‘intangible’ companies, Microsoft and Apple, are easily identified. They have very real market valuations of just under $2 trillion each, much of it related to intellectual property assets like patents, trademarks and trade secrets, as well as licenses.

What is perhaps more interesting are the less familiar names on the top ten list and how they got there.

Saudi Aramco (#3, only slightly behind Apple) and Taiwan Semiconductor Manufacturing Company (#9) have only a fraction of the brand recognition of the others on the list, yet they are among the elite intangible owners. For Saudi Aramco, $1.601 trillion of its $1.644 trillion of intangible value was attributed to ‘undisclosed intangible value,’ accord to a recent report.

This raises questions about the researchers’ interpretation of intangibles for valuation. For semiconductor giant TSMC value likely is associated with their unique patents and valuable trade secrets.

TSMC employees have registered more than 140,000 individual trade secrets under a system introduced in 2013, reports the IAM blog. The company is unique in this increasingly important but difficult to value space.

“Though TSMC owns thousands of patents,” the company says, “trade secrets comprise its most important intellectual property. They are what enables the company’s lead in cutting-edge semiconductor manufacturing, which makes it one of the most important and most valuable technology companies in the world.”

For Saudi Aramco, wealth is possibly derived from industry relationships, agreements and royalties it collects, certainly not from its patent or trademark portfolio.

Global Finance’s GIFT tracker is entirely driven by market cap. It simply subtracts the reported book value of tangible assets to get to the estimated value of intangibles, a controversial approach, that – while used by several market observers- is riddled with issues, and makes for questionable results.

It is not clear what this means for more modest size businesses dependent on intangibles. But recognition of their value is significantly less clear than those of public tech and other giants.

“The $1.9 billion that Saudi Aramco trades at is actually not at all related to intangibles,” says Efrat Kasznik, President of Foresight Valuation Group and a Stanford Lecturer. “It has everything to do with the oil market, where there are many factors impacting oil prices that directly effect this company’s stock performance, which is the driving factor in this calculation.

“You cannot compare a high-capitalized oil and gas company to say Apple by simply removing the tangible assets. It is a lot more complicated than that.”

As noted by Global Finance’s GIFT (Global Intangible Finance Tracker) report, via World Trademark Review, the criteria for evaluation is as follows: the top-ten companies’ non-monetary assets (without physical substance) are grouped into three broad categories – rights (including leases, agreements and contracts), relationships (including a trained workforce) and intellectual property (including brands, patents and copyrights).

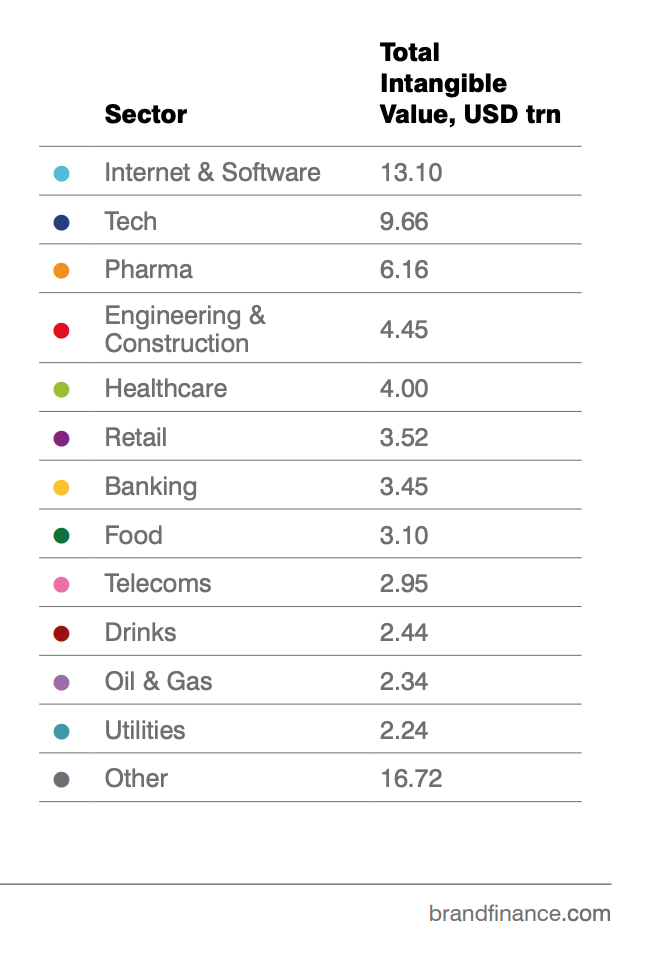

“Over past 25 years, intangibles have seen astronomical growth – increasing 1145% from estimated $6 trillion in 1996,” noted the report.

Microsoft Teams has become embedded into business life for global organizations, once again proving the value of Microsoft’s ability to innovate and roll-out at scale, stated Brand Finance. Microsoft is investing heavily in its business suite solutions.

“Over past 25 years, intangibles have seen astronomical growth – increasing 1145% from estimated $6 trillion in 1996.”

Although Apple is the more valuable company by approximately $200 billion, Microsoft is estimated to have more intangible value with its portfolio of brands and business operations.

The majority of intangible assets are not recognized, due to the limitations set by the financial reporting rules, which state that internally generated intangible assets such as brands cannot be disclosed in a company balance sheet.

Brand Finance and International Valuation Standards Council call for more comprehensive reporting of intangible asset value to facilitate investor understanding and economic recovery post-COVID.

AT&T reported the most disclosed intangible asset value, $270 billion, more than twice that of Verizon.

For the full 2021 Global Intangible Finance Tracker report, go here.

Image source: branddirectory.com