This is the third of a three part post on Spotify’s failure to qualify as an “ESG” stock.

[This is an extension of Spotify’s ESG Fail: Environment and Spotify’s ESG Fail: Social. “ESG” is a Wall Street acronym often attributed to Larry Finkat Blackrock that designates a company as suitable for socially conscious investing based on its “Environmental, Social and Governance” business practices. See the Upright Net Impact data model on Spotify’s sustainability score. As of this writing, the last update of Spotify’s Net Impact score was before the Neil Young scandal.]

Spotify has one big governance problem that permeates its governance like a putrid miasma in the abattoir: “Dual-class stock” sometimes referred to as “supervoting” stock. If you’ve never heard the term, buckle up. I wrote an extensive post on this subject for the New York Daily News that you may find interesting.

Dual class stock allows the holders of those shares–invariably the founders of the public company when it was a private company–to control all votes and control all board seats. Frequently this is accomplished by giving the founders a special class of stock that provides 10 votes for every share or something along those lines. The intention is to give the founders dead hand control over their startup in a kind of corporate reproductive right so that no one can interfere with their vision as envoys of innovation sent by the Gods of the Transhuman Singularity. You know, because technology.

Google was one of the first Silicon Valley startups to adopt this capitalization structure and it is consistent with the Silicon Valley venture capital investor belief in infitilism and the Peter Pan syndrome so that the little children may guide us. The problem is that supervoting stock is forever, well after the founders are bald and porky despite their at-home beach volleyball courts and warmed bidets.

Spotify, Facebook and Google each have a problem with “dual class” stock capitalizations. Because regulators allow these companies to operate with this structure favoring insiders, the already concentrated streaming music industry is largely controlled by Daniel Ek, Sergey Brin, Larry Page and Mark Zuckerberg. (While Amazon and Apple lack the dual class stock structure, Jeff Bezos has an outsized influence over both streaming and physical carriers. Apple’s influence is far more muted given their refusal to implement payola-driven algorithmic enterprise playlist placement for selection and rotation of music and their concentration on music playback hardware.)

The voting power of Ek, Brin, Page and Zuckerberg in their respective companies makes shareholder votes candidates for the least suspenseful events in commercial history. However, based on market share, Spotify essentially controls the music streaming business. Let’s consider some of the implications for competition of this disfavored capitalization technique.

Commissioner Robert Jackson, formerly of the U.S. Securities and Exchange Commission, summed up the problem:

“[D]ual class” voting typically involves capitalization structures that contain two or more classes of shares—one of which has significantly more voting power than the other. That’s distinct from the more common single-class structure, which gives shareholders equal equity and voting power. In a dual-class structure, public shareholders receive shares with one vote per share, while insiders receive shares that empower them with multiple votes. And some firms [Snap, Inc. and Google Class B shares] have recently issued shares that give ordinary public investors no vote at all.

For most of the modern history of American equity markets, the New York Stock Exchange did not list companies with dual-class voting. That’s because the Exchange’s commitment to corporate democracy and accountability dates back to before the Great Depression. But in the midst of the takeover battles of the 1980s, corporate insiders “who saw their firms as being vulnerable to takeovers began lobbying [the exchanges] to liberalize their rules on shareholder voting rights.” Facing pressure from corporate management and fellow exchanges, the NYSE reversed course, and today permits firms to go public with structures that were once prohibited.

Spotify is the dominant streaming firm and the voting power of Spotify stockholders is concentrated in two men: Daniel Ek and Martin Lorentzon. Transitively, those two men literally control the music streaming sector through their voting shares, are extending their horizontal reach into the rapidly consolidating podcasting business and aspire soon to enter the audiobooks vertical. Where do they get the money is a question on every artists lips after hearing the Spotify poormouthing and seeing their royalty statements.

The effects of that control may be subtle; for example, Spotify engages in multi-billion dollar stock buybacks and debt offerings, but has yet makes ever more spectacular losses while refusing to exercise pricing power.

So yes, Spotify is starting to look like the kind of Potemkin Village that investment bankers love because they see oodles of the one thing that matters: Fees.

On the political side, let’s see what the company’s campaign contributions tell us:

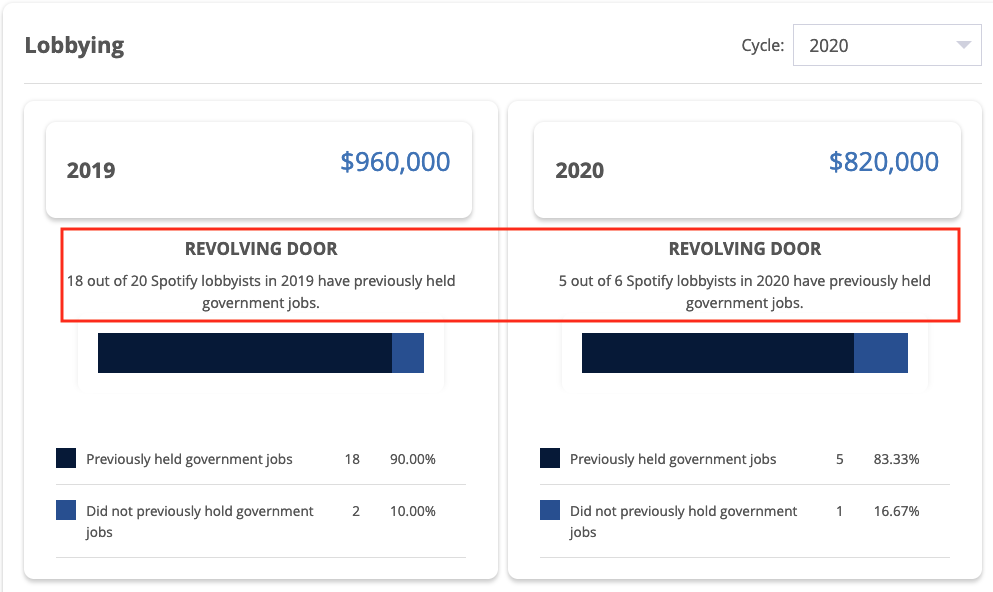

Spotify has also made a habit out of hiring away government regulators like Regan Smith, the former General Counsel and Associate Register of the US Copyright Office who joined Spotify as head of US public policy (a euphemism for bag person) after drafting all of the regulations for the Mechanical Licensing Collective;

Whether this is enough to trip Spotify up on the abuse of political contributions I don’t know, but the revolving door part certainly does call into question Spotify’s ethics.

It does seem that these are the kinds of facts that should be taken into account when determining Spotify’s ESG score. At this point, it looks like Spotify is an ESG fail–which may require divesting by some of the over 600 mutual funds that hold shares.

You must be logged in to post a comment.