It’s easy to appreciate intellectual property licensing. C-level executives and investors of all types are among the many who attracted to the revenue and smitten by the profit margins .

Whether the rights are associated with patents, copyrights or trademarks, out-licensing, while often unpredictable, is easy for most people to wrap their head around, and just the thing to enhance the bottom line. It’s what business is all about – right?

But out-licensing, direct IP income in the form of on-going royalties or other business models, is only one of several types of return that can be generated by IP rights. It is the primary form of ROIP that is most readily measured in dollars and cents.

Often Overlooked

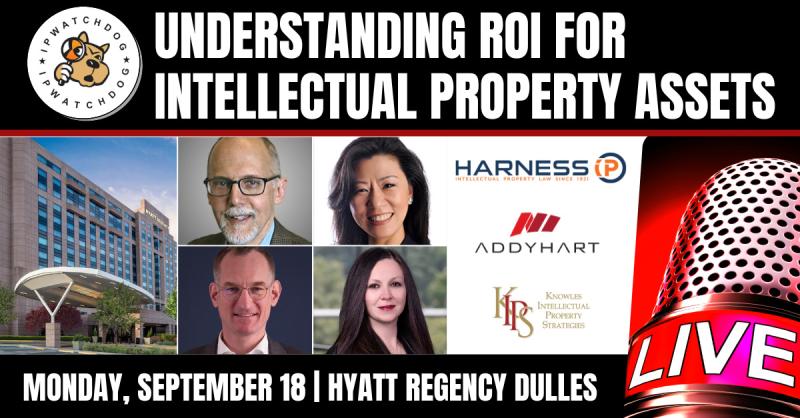

On September 18, ROI on IP will be the topic of an IPWatchdog LIVE panel, moderated by yours truly, Bruce Berman, who has been following developments in ROIP for more than 30 years. ‘Understanding ROI for Intellectual Property Assets’ will feature a range of panelists, including executives from France Brevets, Jones Day and DrFirst, Inc. Go here for more information or to register.

Out-licensing, the term used for generating direct IP income, is only one of several forms of return that can be generated by intellectual property rights.

Often overlooked by astute executives and investors are the types of return that IP, especially patents, can generate. To be fair, without IP rights accurately reflected on company balance sheets (it’s still “goodwill”), it is difficult to measure their value or performance. Management icon Peter Drucker said that “You can’t manage what you can’t measure.” Below is a summary of some IP benefits that are often either under-reported or unrecognized.

IP as a Deterrent – IP rights can slow competition and help protect valuable market share. In some industries, e.g. chem, bio, pharma, patents are a greater deterrent than others. It is not easily measured, but can a strong argument can be presented. Copyrights owned by Disney can also be a significant deterrent to copying and competition, as can trademarks controlled by name brands, such as NIKE.

- Freedom to Operate means testing, prior to launching a product, whether any feature will infringe anyone else’s patents.

- Freedom of Action means having enough patents or enough cross-licenses such that you have the ability to launch products and are comfortable with the risk of patent infringement.

Risk Mitigation – This form of IP return means more to larger businesses, but is relevant to all. To a tech company launching a new product or a pharma business managing exposure could be worth tens or or even hundreds of millions of dollars. While difficult to measure, risk avoidance has significant value to businesses with the most to lose. A purchase, license or settlement can be more valuable than it looks.

In- and Cross-Licenses – In addition to revenue-generating out-licensing, the proper in-license can be worth way more than the cost in royalty payments if it provides the appropriate freedom and enables product sales with the right margins and market share. Similarly, cross-licensing, once a staple of corporations with large patent portfolios, can establish good relationships and dissuade costly disputes.

“The role IP rights and licenses play in avoiding costly litigation and potential damages can be immeasurable,” former IBM , Bill LaFontaine told IP CloseUp recently.

Sale of IP Rights – Unused or under-utilized IP rights, especially patents, can be sold for others to add to their portfolio, license or enforce. Known brands are sometimes sold and so, too, are copyrights. IP sales fall under the heading of “monetization”. Often, non-practicing entities (NPEs) are in a better position to enforce and obtain settlements than operating companies.

Litigation – Patent and other IP suits that generate settlements, royalties and, especially, damages, while costly and time consuming, can be financially rewarding. A handful of patent suits have resulted in damages in excess of a billion dollars. But those wins are few and far between. The 2017 median damages award increased to $10.2 million, up from $6.1 million in 2016. 95% to 97% of patent suits end in a settlement.

With patent litigation a win that requires multiple appeals and PTAB petitions can cost in excess of $10 million and take five years. It is less viable way to generate a return today than before the American Invents Act went into effect in 2012 and when injunctions could be obtained, pre Ebay.

Emergence of litigation funding sources, has made more enforcement possible with less financial risk. Needless to say, they are extremely selective, backing as few as 2% of the suits they review. Many argue that sharing enforcement risk with investors levels the playing field for those (individuals and businesses) whose believe their inventions are infringed.

Mergers & Acquisitions – Depending on the industry, IP rights can play a significant role in company acquisitions, when they are associated with brands, copyrights and patents. In tech buyouts, patents, mistakenly I am told, are often an afterthought. They are considered late in the due diligence stage, when it is too late to use them as seller or buyer bargaining chit. A patent portfolio, for example, can be worth more in the context of a transaction or liquidity event than in direct revenue generation.

Capital Formation & Finance – Depending on what they cover and if they are income generating, the cost of raising capital with IP assets can be lower. Revenue-producing, and in some cases even strategic or defensive, IP rights can sometimes be “collateralized” or used to borrow. The discount relative to hard assets (e.g. real estate, equipment) is usually steeper.

Securitization – In some industries, such as pharma, future royalty flows can be sold to investors, who speculate on the reliability and duration of future returns. If the buyer calculates properly, there can be an upside. For the seller, locking in gains can realize a discounted return now and minimize the risk of a new drug or modality undermining revenue down the road.

Reputation – Reputation for innovation, creative expression, brand equity or trade secrets can be invaluable. It is typically earned over time and at a high cost. Smart companies are adept at cultivating, managing and perpetuating their reputation for IP success. Some are able to use their brand reputation to enhance patent value (Apple. L’Oreal). Others deploy their patent value as a brand (Qualcomm). Trade secrets can work in tandem with patents (Coca Cola), and copyrights with trademarks (Disney).

Strong IP positions attributable to specific rights, properly communicated to investors over time, can have a significant impact on shareholder value.

“Know-Go” – Negative know-how, or the research that a businesses knows it does not currently have for a successful outcome, but is likely to bring it closer to one, can be an incredibly valuable by-product of R&D. This is true in any inventive industry but especially so in pharma. Thomas Edison famously said: “I have not failed. I’ve just found 10,000 ways that won’t work.”

*****

Please join us in Washington on Monday September 18th for ‘Understanding ROI for Intellectual Property Assets.’ It is sure to be a lively discussion. Go here to register.

Image source: searchenginejournal.com; IPWatchdog.com