Despite the high economic relevance of innovation and explosive invention growth reflected in the number of patents issued annually by the United States Patent and Trademark Office (USPTO), patent law suits and cumulative damages awards have declined and are significantly below their highs.

Given the volume of inventions, why are there not more more disputes? Some would argue that the quality of patent issuances is lacking; others that lack of direction from the courts and legislation may have overcorrected a problem that was less of a threat than a campaign to neutralize competition. Still others would cite the high cost and protracted timeline of resolution.

The USPTO granted 374,006 utility patents in 2021 alone, more than twice the number in 2004, 164,290. According to Statista, a total of 3.34 million U.S. patents were issued between 2004 and 2022. Many more haven been issued worldwide and a good many still are active.

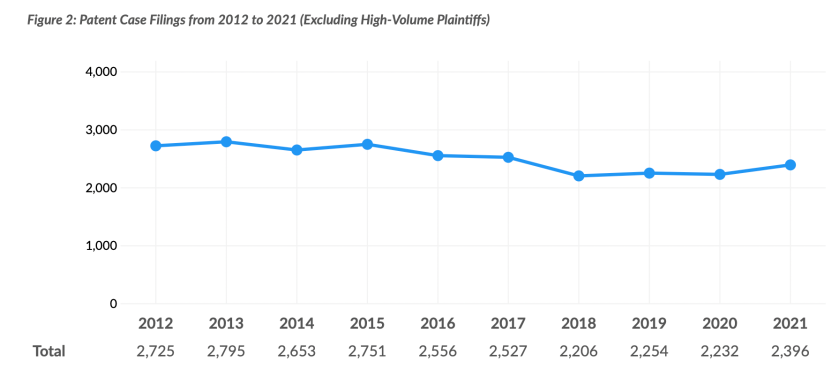

According to a recently released study conducted by Lex Machina, the 2022 “Patent Litigation Report,” about 4,000 U.S. patents are litigated annually, fewer than 2,500 if “volume” filers are excluded, such as WSOU Investments and Cedar Lane Technologies.

Average number of suits filed annually are 0.11764% of the approximately 3.34 million issued patents from 2004-2020 (about one tenth of one percent). The number of patent suits that go to trial annually (under 200) as percent of suits filed (4,000) is about 5%.

The percent of patents that go to trial from all of those in force, 3.34 million, is 0.00588% or less than 1/100th of a percent according to IP CloseUp’s calculation.

U.S. Patent Suits Filed, 2012-2021

These are incredibly low numbers, unless, of course, if you are a defendant in a case.

Patent litigation poses less of a literal financial threat to most large companies than the headlines would have us believe. Still, why should defendants pay anything if they can avoid it? But are they avoiding payment fairly on the merits or because the patent system fails to represent the interests of smaller and mid-size companies and independent inventors who are likely to allege infringement?

Non-practicing entities (NPEs), patent licensing businesses that are frequently unable to effect transactions and have to resort to litigation, acquire their patents from businesses or inventors that are ill-equipped to enter into battle with infringers.

Highly profitable companies can easily out-lawyer plaintiffs. Does this give them a license to use others’ inventions without paying, so-called “efficient infringement”? In the scheme of things they are infrequently sued for patent infringement and when they are they seldom lose. If they do lose it may cost them ten’s of millions of dollars as opposed to potentially hundreds of millions in licensing fees. While shareholders may applaud this behavior, if they understood the impact on innovation, jobs and the economy they may not be so entertained.

Fear of Disruption

Contrary to what some highly successful companies would have us believe, not all important inventions or improvements emanate from their labs. Businesses spending the most on R&D and employing the best-credentialed researchers frequently are unable to provide the inventions necessary to improve existing products or to generate sufficient disruption that lead to new businesses and industries. In the pharmaceutical industry, however, discoveries and commercialization are more directly associated with significant investment.

Total damages awarded from 65 cases coming to fruition on 2021 were $3.965 billion dollars, reports Lex Machina, for an average of $61,000,000 per suit. Some awards were much smaller, as little as a few million dollars, and a few quite large, greater than $300 million. Many are never paid. The cost to litigate a patent case today ranges from about $2.5 million to well over $10 million and the timeline from two years to more than five.

A total of 13 non-financial companies in the S&P 500, including many tech giants like Apple(AAPL), Google-parent Alphabet (GOOGL) and IBD Long-Term Leader Microsoft (MSFT), are sitting on cash and investments of more than a $1 trillion, says an Investor’s Business Daily analysis of updated data from S&P Global Market Intelligence and MarketSmith. Apple alone has $202 billion dollars in reported cash.

Patent Suits Filed, 2012-2021, Excluding High-Volume Filers (NPEs)

Some technology business are fighting tooth and nail, with virtually unlimited resources and every legal tactic at their disposal, to preserve a way of life. It is not a matter of cost or time. It is a matter of reputation and precedent. A continued favorable playing field for them means fewer potential threats. Remember: companies like Kodak, Polaroid, Xerox, Compaq and Minolta were once tech giants.

Patents – The Anti-Monopoly ‘Monopoly’

While invincibility to IP threats helps to establish bigger, wealthier companies better equipped to employ more people, deliver cheaper products and battle adversaries like to China (as long as they are not partnering with them). The high patent licensing bar also makes it harder for disruptive but important innovation to find a home, and it challenges the nature and source of what is truly innovative. Established businesses tend to believe an invention is important when they own it or they can control who does.

Successful businesses have an array of tools to discourage competition: Weakening IP rights through lobbying, legislation and false narratives, favorable court decisions and questioning the credibility of owners, be they practicing or not, who attempt to license.

The largest volume plaintiffs, “Patent Assertion Entities,” are WSOU Investments and Cedar Lane Technologies with 199 and 191 patent suits filed from 2019-2021. These businesses appear to have been established to sue. Not all licensing companies wish to be in the litigation business, but are forced to because reasonable terms do not interest many defendants, especially if they are better positioned to allow the dispute to play out in court.

Both WSOU and Cedar Lane appear to be volume fliers, patent trolls in the classic sense, buying relatively cheap (certainly less than the cost of conducting internal R&D) and “darkening the skies” with suits in an effort to encourage defendants to settle. Are they enforcing what the original owners, did not have they the time, capital or experience to? According to RPX Corp. WSOU Investments obtained approximately 4,000 patents from Nokia and Alcatel-Lucent.

Do NPEs, volume-filers or not, keep tech companies honest and credit for inventing relevant, or are they merely predators, attempting to game the system as some did in the 1990s and early 2000s? It depends on what is being asserted. Not all NPEs are created equal, nor are all patents.

If large defendants like Apple, Google and Huawei settled the numerous suits that have been filed against them — not that they should — it would be less than a blip on their respective balance sheet. Perhaps not even a footnote on a 10Q. Losing or settling is not something large, strangely vulnerable businesses want to establish as a possibility. But at what cost?

Given the explosive volume of inventions and patents over the past few decades, it is amazing how few technology disputes occur. It may have to do with the continually increasing cost and expanding timeline of litigation. The proliferation of litigation funders has helped a few patent plaintiffs somewhat. But with the threat of an injunction essentially removed (EBay), there is little financial incentive for defendants to take a license or settle.

What, Me Worry?

There could be a moral incentive to taking a license if customers and shareholders were better informed about how a ‘hold out’ strategy impacts and undermines innovation and inventors, and affects jobs and global competition with adversaries. Sharing the spoils where appropriate does not mean admitting defeat. It is what the patent system and courts were originally intended to decide.

Many technology businesses that license patents are often forced to do so contentiously through litigation. Often, they are not assertion entities by nature as much as by necessity. Most would rather effect licenses on reasonable terms. Patent licensing has never been easy, but it has never been so arduous as it is today. Licensing and its cousin, litigation, have become synonymous with bad behavior because the real bad actors profit from that narrative. Sooner or later people will figure it out and determine that a not quite level playing field is better than no field at all.

Go here for a copy of Lex Machina’s 2022 Patent Litigation Report.

Image source: LexMachina