The rise of EV patents in India

Every year, India finds itself in the unenviable position of having some of the most polluted cities in the world. With approximately 300 million registered vehicles in India running on fuel sourced from crude oil, pollution from automobiles is a significant contributor to the perceptible deterioration in air quality. Although India’s emission standards are aligned with global ones, the rapid increase in the number of vehicles on the roads is cancelling out any benefits of the tightening of rules around carbon emissions.

Emissions from the transportation sector account for one third of the total greenhouse gas emissions in the developed world. Countries around the globe have started realising that a fundamental shift in transportation norms is required to reduce overall greenhouse gas emissions, and thus many nations have already set targets for phasing out internal combustion engine-based vehicles completely by the next decade. Consequently, the past few years have seen rapid development of electric vehicle (EV) technologies. Global consensus and policy tweaking has put innovation in the EV sector on a fast track and the resulting IP protection is not far behind. Figure 1 shows the trends in filing of patents relating to EV technology - observed to be increasing from 2016 until 2022 - in various regions such as the United States, Europe, Japan, Korea and China. The numbers indicate that there has been robust activity in this technology space from 2015 to 2020, with a slowdown in 2020-21, possibly due to the impact of covid-19 on global business and supply chains.

Figure 1: EV technology patent publishing trends from 2015 to 2022 (July) for China, Europe, Japan, Korea and the United States of America (Derwent World Patents Index)

Keeping up with global trends and initiatives, the Indian government has also taken up the cause and has been focusing on maintaining energy security interests and its commitments under the global climate change agreements. To this effect, adoption of EVs has been one of the main focuses of the government. It launched Phase 1 of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) programme in April 2015, closely followed by the second phase commencing in April 2019 with a budget of Rs10,000 (approximately $1.25 billion) for five years. This policy covers electric and hybrid technologies, including mild-hybrid, strong-hybrid, plug-in hybrid and battery EVs.

With batteries being one of the most important parts of an EV, the government also approved the Product Linked Incentive (PLI) scheme for advanced chemistry cell battery manufacturing on 12 May 2021. PLI schemes provide incentives for manufacturing in India. The outlay for this scheme is Rs18,100 (approximately $2.27 billion) for five years. Since the announcement of the above scheme, various local and multinational manufacturers have started setting up battery manufacturing projects in India.

Impetus from the government along with technology adoption has certainly facilitated the implementation of EVs in India, which is reflected in the threefold rise of EV sales between FY 2020-21 and FY 2021-22. The Ministry of Heavy Industries estimates that by 2030, 80% of two-wheelers and 30% of cars on Indian roads will be EVs. Regarding public transport, various Indian cities have started deploying electric buses by taking advantage of the FAME scheme. Closely following the Union Government, over 14 of India’s 28 states have almost finalised EV policies that support the national electric mobility policies.

The government incentives and the related rise in adoption of EVs in India has translated into increased IP protection in this technology space, which is reflected in the country’s patent filings. Published patent applications in the field of EVs and allied technology have been steadily rising since 2017 (see Figure 2).

Figure 2: EV technology patent publication trends in India from 2017 to 2022 (July) (Derwent World Patents Index)

Figure 3: Top assignees or applicants in India for EV-related patents (Derwent World Patents Index)

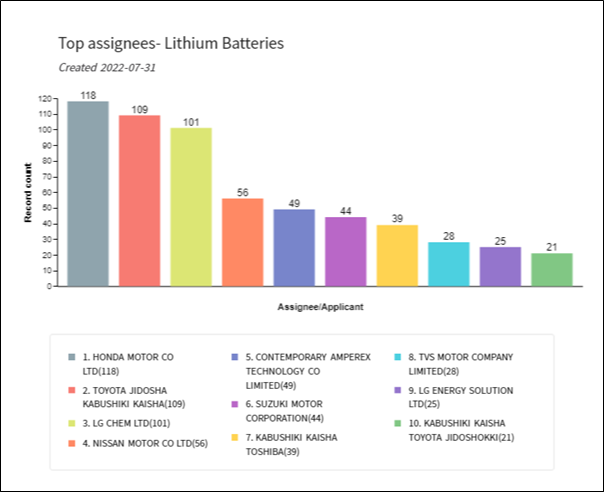

A closer look at the filing data reveals that Honda Motor Co Ltd was one of the top filers of patent applications in these years, closely followed by LG Chem Ltd and Toyota Jidosha Kabushiki Kaisha.

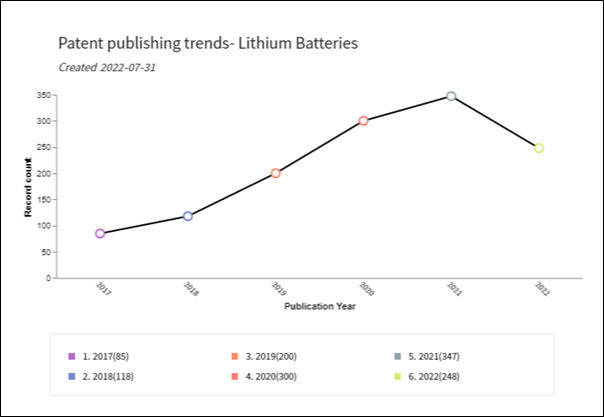

As shown in Figures 4 and 5, the positive effects of government schemes are reflected in the filings related to lithium batteries, which are indispensable to EVs.

Figure 4: Patent publication trends in India from 2017 to 2022 for lithium batteries in EVs (Derwent World Patents Index)

Figure 5: Top assignees or applicants for lithium battery-related technology in India (Derwent World Patents Index)

Even though patent filings related to lithium ion batteries and allied technologies have leapt over the years, India started manufacturing such batteries quite recently. India has been relying on imports from China and Taiwan in the last few years to meet the needs of li-ion cells. The PLI Scheme rollout has, however, incentivised battery manufacturing in India since 2021. Toshiba Corporation, DENSO Corporation and Suzuki Motor Corporation have set up TDS Lithium-Ion Battery Gujarat Private Ltd in the state of Gujarat for manufacture and supply of li-ion batteries. Closely following suit are Exide Industries, Tata Chemicals, Epsilon Carbon, Manikaran Power Ltd, among others. The Indian Space Research Organisation (ISRO) also signed a memorandum of understanding with Bharat Heavy Electricals Ltd to manufacture li-ion batteries for EVs in India. Further, ISRO also announced that its lithium-ion cell technology will be shared on a non-exclusive basis with various companies such as Amara Raja Batteries Ltd, HBL Power Systems Limited, Su-Kam Power Systems and the battery manufacturer company OKAYA.

While steps taken by the Indian policymaking apparatus have seen rapid adoption of EVs in India, some challenges remain in realising the sector’s full potential. The Parliamentary Standing Committee, in its report on electric and hybrid mobility in India (6December 2021), noted areas where work needs to be done. Tax incentives require further rationalisation to nudge people towards EVs rather than internal combustion engine vehicles. India also needs to augment its R&D infrastructure to quicken the pace of innovation in the EV sector. An extensive network of charging stations will also be indispensable for EVs to eventually succeed – this being an important factor in a country that is still working towards ensuring uninterrupted power supply.

Although EVs still form a tiny percentage of overall automobile sales in India, the potential for growth in the sector is immense – as demonstrated by the recent surge of EVs entering the market by car manufacturers such as Tata, MG, Audi, Mercedes, BMW, Volvo, Kia and Porsche. The active participation of foreign players in setting up manufacturing units for EV components in India reflects the crucial role that EVs will play, not only in reducing overall carbon emissions, but also in the growth of the Indian economy. We expect that the coming months and years will witness even more active IP filings in EV-related technologies in India.

This is an Insight article, written by a selected partner as part of IAM's co-published content. Read more on Insight

Copyright © Law Business ResearchCompany Number: 03281866 VAT: GB 160 7529 10