Understanding the Corporate Tax Obligations for Natural Persons Under UAE Law

LexBlog IP

MARCH 4, 2024

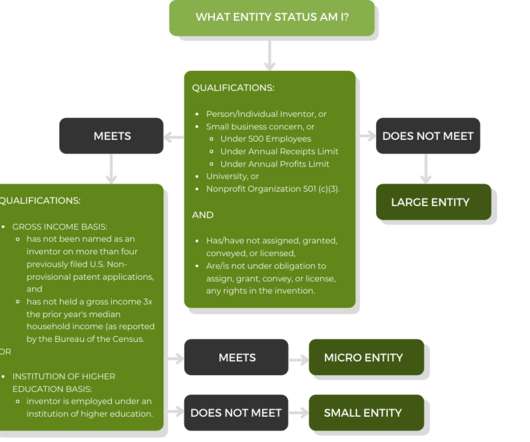

47/2022 on the Taxation of Corporations and Businesses (Corporate Tax Law), establishes the legislative framework for imposing federal tax on corporations and business profits in the UAE. Juridical persons include entities recognized under UAE laws or foreign laws, holding a legal identity distinct from their founders.

Let's personalize your content